Have you recently got a letter from your home insurance company?

And it says they want to come take a look at your place.

You might be wondering what’s up.

Don’t worry. It’s usually nothing bad.

Insurance companies just like to do an occasional once-over to make sure they have all the right information about your home. This helps them evaluate if you have the proper coverage or if they need to adjust anything.

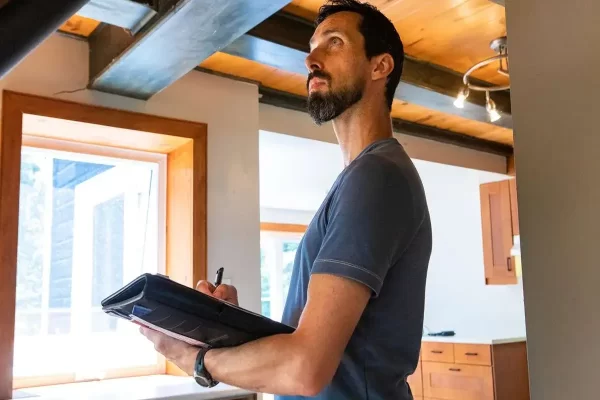

The inspection itself is pretty simple and non-invasive. The inspectors will come to walk through your house, inside and outside, and take notes about your home’s condition. They will examine the features like roof, foundation, doors, windows, HVAC, plumbing, electrical, and other systems and structures. They may take some measurements or pictures. And then document their findings in a detailed inspection report.

The inspectors also check your place to confirm if all the details about your home match what’s listed on your policy. If anything is different, they’ll update your coverage accordingly. For instance, getting your kitchen or bathroom renovated or finishing your basement.

Are you on the fence about why bother with a home inspection for insurance?

Home inspections might sound mundane, but there are good reasons for insurance companies to conduct them. For instance, your insurance company will make sure you have adequate coverage. If your policy limits are too low, you risk being underinsured in the event of a claim.

Apart from that, you catch any existing or potential issues beforehand. An insurance inspector might notice any wear and tear you haven’t, like an aging roof. This allows you to take preventative action before further damage occurs.

And above all, accuracy equals better premiums. Keeping your policy 100% up-to-date with your home’s features will help you lock in the best rates in the future.

So, going forward with this, let’s discuss in detail:

Why Does My Insurance Company Want to Inspect My House?

It’s completely normal to get puzzled, annoyed, or panicked when you get a letter for a home insurance inspection request. But the question raised here is WHY?

Why do they need to send someone to look over your place? Isn’t the information you gave them enough?

While it may feel intrusive. But there are a few good reasons insurance companies want to visually inspect houses they cover. And it will eventually be of your benefit. So, let’s get into those reasons.

Underwriting Purposes

An insurance inspector will examine different aspects of your home, both structures and systems. This may include the age and condition of the roof, the electrical and plumbing systems, the foundation, and more. This allows them to evaluate the overall condition and associated risks of your home. So they can set accurate premiums and coverage limits.

Risk Assessment

A home inspection for insurance lets the insurer check that your home matches the details you have already provided on the policy application. If anything is different, the risk level might need to be adjusted. This protects both you and the insurer.

Verification of Information

An insurance inspector will verify all important details you provided the company earlier. For instance, your home’s size, the materials you used during the construction, and more. This confirms that the policy details and quotes are based on accurate and up-to-date data.

Loss Prevention

Inspections can catch minor issues before they become major insurance claims. For instance, issues like roof wear, old wiring, cracked foundations, etc. When a home insurance inspection highlights these problems, the insurance company can demand preventative repairs that reduce any future risks.

Claims Processing

A detailed home insurance inspection acts as a record of damages and processing. And it will be an evidence or helpful tool in case you ever do need to file a claim. This makes the payouts much simpler and faster.

When Is a Home Inspection for Insurance Required?

So, your insurance company informed you that your home inspection is mandatory – before they can issue or renew your policy. You may be curious what triggers that all of a sudden. Well, it’s got nothing from you but their policy on your coverage. So cooperating with them to inspect your place comes first.

As we have understood why it’s required. Let us now take you through the common times when a home insurance inspection is unskippable. So here are the peak times you can expect to hear from your home insurance company.

New Insurance Policies

It’s standard for insurers to inspect a house before issuing coverage for the very first time. All they want is to evaluate risk, verify details, and check for pre-existing damage, etc. So they can set accurate premiums and coverage limits from day one.

Renewal or Policy Changes

Insurers also typically need a fresh inspection when you renew your policy. They also need one when you request significant changes in coverage. If it’s been years since the last inspection, they want an updated assessment.

Older Home

The older your home is, the more critical inspections become for insurers. They need to assess systems that are prone to aging-related issues in vintage houses. This may include catching problems in foundations, roofing, electrical, plumbing, etc. They reduce claims.

Switching Insurance Company

Your new insurance company will insist on an inspection. So it can evaluate your home with its own criteria before approving your coverage. Your new company won’t rely on the older inspection data from your prior insurer.

No Inspection for Over a Decade

Even if none of the above apply in your case, most carriers automatically require a new inspection at least once every 5-10 years. Mortgages and codes also require regular property evaluations.

Can I Refuse a Home Insurance Inspection?

Saying “No Thanks” to a Home Insurance Inspection?

When your home insurer informs you that your property needs an insurance inspection, what would be your reaction? You might be tempted to tell them to take a hike. And you just want to refuse your home insurance inspection request.

If you can relate to this situation, unfortunately, you don’t have the option to decline. If you really want to maintain insurance coverage over your home. You’ll have to cooperate with your company to inspect your property whenever needed. Here’s why

Insurers Have the Final Call

Language in most home insurance policies grants the carrier the right to inspect your insured property on reasonable notice. This inspection clause gives them the power to mandate access, regardless of your objections.

It’s a Standard Policy Condition

Consenting to occasional inspections is a basic condition of maintaining almost any home insurance policy. You agree to this when signing the policy documents.

Lack of Access Could Allow Cancellation

If you refuse reasonable inspection requests, you usually violate the standard cooperation clause in insurance contracts. This allows the insurer to cancel or non-renew your policy due to “failure to cooperate.”

Bottom Line

While you may dislike the invasion of privacy in your home, an insurance inspection is still needed. It provides you with valuable risk management data to secure your family’s future.

Total House Inspection guided you throughout the home inspection for insurance. We suggest you cooperate with your insurance company and let them inspect your home. Before your coverage gets at risk. Scroll through our blog section to learn more about inspection.